What Is an IPO?

An Initial Public Offering is when a private company offers its shares to the public for the first time on a stock exchange.

In simple words — it’s the company’s way of inviting common investors like you to become part owners.

For example, when Zomato, LIC, or PhysicsWallah launched their IPOs, they allowed the public to buy shares and participate in their future growth.

Also Read: The PhysicsWallah IPO 2025: Opportunity, Risks & How to Analyse.

Table of Contents

Why Do Companies Launch IPOs?

Companies go public for several reasons:

- Raising Capital: To fund expansion, pay off debts, or invest in new projects.

- Brand Recognition: Listing on the stock market boosts visibility and trust.

- Liquidity for Founders & Early Investors: Existing shareholders can sell part of their holdings.

- Corporate Transparency: Public companies must follow SEBI regulations, building investor confidence.

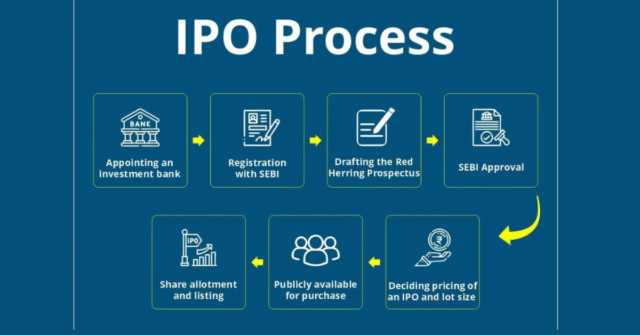

How Does the IPO Process Work in India?

The IPO journey typically follows these eight key steps:

1. Appointing a Merchant Banker

Companies hire financial experts (underwriters) (like ICICI Securities, Axis Capital, Kotak, etc.) to manage the IPO process

2. Filing the Draft Red Herring Prospectus (DRHP)

The DRHP contains all details about the company — business model, financials, risks, and how the raised money will be used.

You can read it on SEBI’s website.

3. SEBI Approval

The Securities and Exchange Board of India reviews and approves the IPO proposal.

4. Price Band & Lot Size Announcement

The company and merchant banker decide the price band (example: ₹100–₹110) based on investors demand and market conditions and lot size (minimum shares you must buy).

5. IPO Bidding

The IPO opens for 3 working days, allowing investors to apply through their broker, net banking, or UPI.

6. Allotment & Refund

After bidding, shares are allotted based on demand. If you don’t get shares, your money is refunded.

7. Listing on the Stock Exchange

Once listed on NSE or BSE, the company’s shares are traded live — and prices can rise or fall based on demand and supply.

8. Luck up Period

Promoters and certain share holders are often subject to luck up period; in this period, they cannot sell shares.

How to Apply for an IPO in India (Step-by-Step)

- Open a Demat & Trading Account (through Zerodha, Groww, Upstox, etc.)

- Check Upcoming IPOs on NSE/BSE or financial platforms.

- Choose the IPO you want to apply for.

- Enter Bid Details: Select lot size and price within the band.

- Authorize via UPI or Net Banking.

- Wait for Allotment Result (check on registrar sites like Link Intime or KFintech).

How to Analyze an IPO Before Investing

Use these five filters to make smarter decisions:

- Business Model: Is the company solving a real problem?

- Financials: Look at revenue, profit trends, and debt levels.

- Valuation: Compare with peers in the same industry.

- Promoter Background: Check credibility and experience.

- Use of Funds: How will IPO proceeds be used — growth or debt repayment?

Successful IPOs in India

Company | Listing Year | Listing Gain | Sector |

Avenue Supermarts (DMart) | 2017 | +102% | Retail |

IRCTC | 2019 | +127% | Travel/Tech |

Nykaa | 2021 | +79% | E-commerce |

Zomato | 2021 | +53% | Food Delivery |

Life Insurance Corp (LIC) | 2022 | –8% | Insurance |

Observation: Not every IPO guarantees profit — but good analysis can help you identify winners.

Also read: The Art of Choosing Winning Stocks for Long Term Wealth.

Types of IPO Investors

There are three main investor categories:

Category | Who Can Apply | Reservation |

Retail Investor (RII) | Individuals investing up to ₹2 lakh | 35% |

Non-Institutional Investor (NII/HNI) | Individuals investing above ₹2 lakh | 15% |

Qualified Institutional Buyers (QIBs) | Banks, mutual funds, insurance firms | 50% |

Advantages of Investing in IPOs

- Early Entry Advantage: You can invest in a company before it becomes widely traded.

2. Potential for High Returns: Many IPOs list at a premium (for example, IRCTC or Dmart).

3. Transparency: The company’s DRHP reveals full details.

4. Portfolio Diversification: Exposure to new sectors and growth opportunities.

Risks of IPO Investment

While IPOs can be rewarding, they also come with risks:

- Uncertain Listing Gains: Prices can fall after listing (as seen in Paytm or LIC).

- Overvaluation: Some IPOs are overpriced compared to earnings.

- Lack of Track Record: Newly listed firms may not have long-term performance history.

- Market Sentiment: IPO success often depends on broader market trends.

Tip: Always study the company’s fundamentals before applying — don’t rely solely on hype or grey market premium (GMP).

Final Thoughts

“An IPO is like a doorway — it opens new investment opportunities. But before walking in, make sure you know what’s inside.”

IPOs in India will continue to grow as more startups go public. As an investor, understanding the process, risks, and strategy can help you make confident and informed decisions.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.