If you’re stepping into the world of investing, you’ve likely come across the term “stocks.” But did you know that not all stocks are the same? They can be grouped into categories based on various factors like their size, sector, performance, and more. Understanding these classifications of stock can help you build a diversified investment portfolio tailored to your goals.

Let’s break down the classifications of stocks in simple terms, with examples to make it easy to follow.

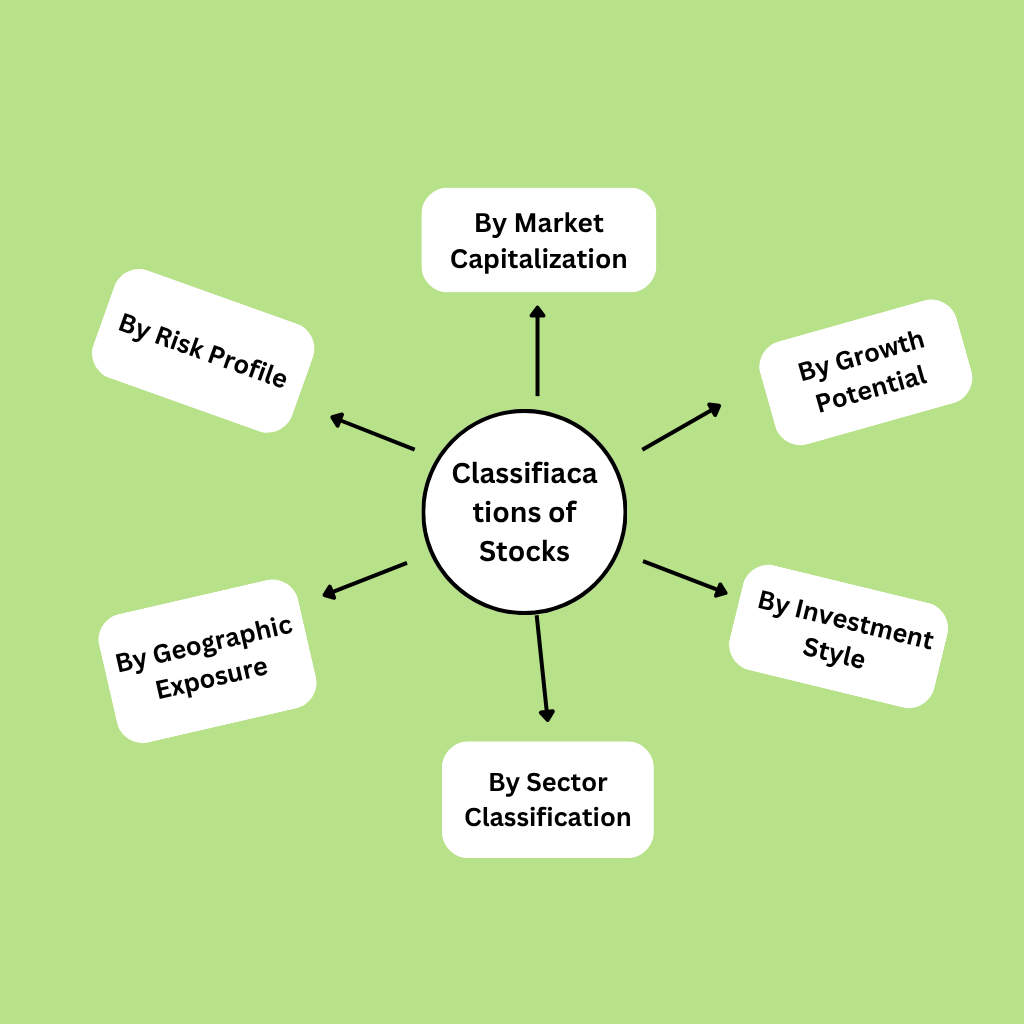

Stocks can be classified based on various criteria, including their characteristics, market capitalization, growth potential, and industry sectors. Here’s an overview of the primary classifications of stocks:

Table of Contents

By Market Capitalization

Market capitalization (or “market cap”) is the total value of a company’s outstanding shares.

Market Cap = Current Share Price × Total Number of Shares.

Large-Cap Stocks: Those Companies with a market capitalization of $10 billion or more. Typically, more stable and less volatile. And often considered as safe Investment. Example: Apple (AAPL), Microsoft (MSFT), and Reliance Industries (RELIANCE).

Mid-Cap Stocks: Companies with a market capitalization between $2 billion and $10 billion. They often have growth potential while still being relatively stable. Example: Pidilite Industries, Domino’s (operated by Jubilant Food Works in India).

Small-Cap Stocks: Companies with a market capitalization of less than $2 billion. They can offer higher growth potential but are generally more volatile. It may be come with higher risk. Example: Mahanagar Gas, CDSL, Angel One etc.

A smart investor doesn’t put all their money into one type of stock — they combine large-cap stability, mid-cap growth, and small-cap potential.

By Growth Potential

Growth Stocks: Those Companies expected to grow at an above-average rate compared to their industry or the overall market. These stocks typically reinvest earnings for expansion rather than paying dividends. Example: Tesla, Nykaa.

Value Stocks: Stocks that are considered undervalued based on fundamental analysis, often trading at a lower price-to-earnings (P/E) ratio. Investors expect these stocks to provide better returns as their true value is realized. Example: ITC, Tata Motors

Dividend Stocks: Companies that pay regular dividends to shareholders. These are often well-established companies with stable earnings. Example: Hindustan Unilever, Vedanta Ltd, NTPC, BPCL etc.

By Investment Style

Defensive Stocks: Stocks that provide consistent dividends and stable earnings, regardless of market conditions. These stocks are less sensitive to economic cycles (e.g., utilities, consumer staples). Example: Nestle, Colgate-Palmolive.

Cyclical Stocks: Stocks whose performance is closely tied to the economic cycle. They tend to do well in economic expansions and poorly in recessions (e.g., automotive, travel). Example: Tata Steel, Maruti Suzuki.

By Sector Classification

Classifications of stocks based on the sector in which they operate, such as:

- Technology – TCS LTD, INFOSYS, HCL Technpologies, Meta, Intel, Alphabet etc.

- Healthcare – Cipla, Apollo Hospitals, Dr Lal Path Labs etc.

- Financials – HDFC Bank, SBI Babk, ICICI Bank etc.

- Consumer Discretionary – HUL, Britania, Marico etc.

- Power – Tata Power, IREDA Ltd, Adani Power etc.

- Capital Goods – BHEL, Havells India, Apar Ind etc

- Oil and Gas – BPCL, Reliance Ind etc.

- Insurance – LIC India, ICICI Podetial Ltd etc

- Telecommunications – Bharti Airtel, Vodafone Idea, Tata Teleservice etc

- Real Estate – DLF, Oberoi Reality etc.

By Geographic Exposure

Domestic Stocks: Companies that operate primarily within a single country. Example: Infosys, Asia Paints, SBI Bank (listed on the NSE/BSE in India).

International Stocks: Companies based outside your home country, offering exposure to foreign markets. Example: Apple, Intel, Meta, Telsa (listed on NASDAQ).

Emerging Market Stocks: Companies from developing economies, which may offer higher growth potential but come with increased risk. Example: Alibaba (China), Tata Motors (India).

Classifications of Stocks By Risk Profile

Blue-Chip Stocks: Large, established companies with a history of reliable performance and dividend payments. Generally considered low-risk. Example: Coca-Cola, Infosys.

Penny Stocks: Low-priced stocks, typically of small companies, that can be very volatile and risky. Example: Small, lesser-known companies listed on smaller exchanges. Or having lower Market capital.

Disclaimer

The content on this platform is for informational and educational purposes only and should not be considered financial, investment, or legal advice. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, reliability, or suitability of the information provided