Exchange Traded Funds (ETFs) are investment funds that are traded on stock exchanges, similar to individual stocks like SBI, Reliance, Amazon etc. They are designed to track the performance of a specific index – Nifty50, sector – Banking, commodity – Gold, Oil, or asset class – Real Estate.

Here’s a comprehensive overview of ETFs:

Table of Contents

1. What is an Exchange Traded Funds?

- An Exchange traded funds holds a collection of assets, like stocks, bonds, commodities, or other securities. It offers investors exposure to these assets without requiring them to buy each individually.

- Trading: ETFs are bought and sold throughout the trading day on stock exchanges, with prices fluctuating based on supply and demand.

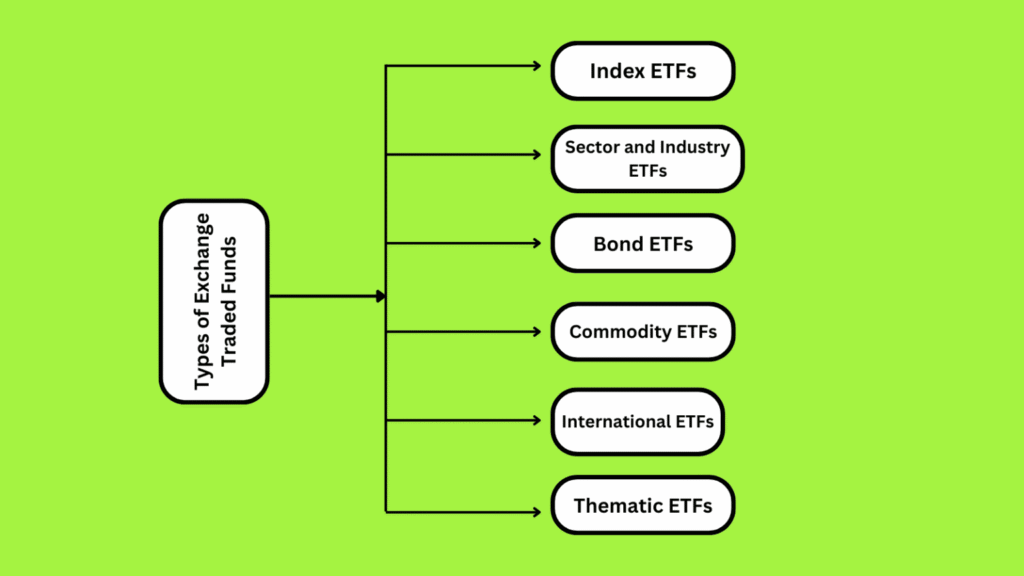

Types of ETFs

- Index ETFs: Track a specific market index (e.g., Nifty 50, S&P 500, NASDAQ-100).

- Sector and Industry ETFs: Focus on specific sectors (e.g., technology, healthcare) or industries.

- Bond ETFs: Invest in a variety of bonds, such as government, corporate, or municipal bonds.

- Commodity ETFs: Track the performance of commodities like gold, silver, oil, or agricultural products like corn, cotton etc.

- International ETFs: Provide exposure to markets outside your home country or region.Like NASDAQ-100,

Dow Jones Industrial Average Etfs Spdr

- Thematic ETFs: Focus on specific themes or trends (e.g., clean energy, artificial intelligence).

- Actively Managed ETFs: Managed by a team of professionals who actively select the assets in the fund, aiming to outperform a benchmark.

3. Benefits of ETFs

Diversification: Investing in an Exchange traded funds allows for exposure to a broad range of assets, reducing individual investment risk.

- Liquidity: ETFs can be traded anytime during market hours at market prices, providing flexibility.

- Cost-Effective: Generally lower expense ratios compared to mutual funds, making them a cost-effective option for investors.

- Transparency: Most Exchange traded funds disclose their holdings daily, allowing investors to see what assets are in the fund.

- Tax Efficiency: ETFs typically have lower capital gains distributions compared to mutual funds due to their structure.

4. How to Invest in ETFs Open a Brokerage Account:

Choose a best brokerage platform that offers access to ETFs.

Research ETFs: Analyse the performance, expense ratios, holdings, and tracking error of different ETFs to find those that align with your investment goals.

Place Orders: Buy and sell ETF shares just like individual stocks using market or limit orders.

5. Considerations When investing in ETFs

- Expense Ratios: Even though ETFs are generally low-cost, it’s essential to compare expense ratios among similar funds.

- Tracking Error: Assess how closely an ETF tracks its underlying index; a high tracking error may indicate inefficiencies.

- Liquidity: Check the trading volume and bid-ask spread, as more liquid ETFs tend to have lower trading costs.

- Investment Goals: Align your ETF investments with your overall investment strategy, risk tolerance, and time horizon.

6. Risks of ETFs

- Market Risk: Like any other investments, ETFs are also subject to market fluctuations and can lose their value.

- Sector/Concentration Risk: Investing in sector-specific ETFs can expose you to higher volatility based on sector performance.

- Tracking Error Risk: An ETF may not perfectly track its underlying index, leading to potential discrepancies in performance.

Exchange traded funds are versatile investment vehicles that provide a range of benefits, including diversification, liquidity, and cost efficiency. They are suitable for both beginner and experienced investors looking to gain exposure to various markets and asset classes. When considering investing in ETFs, it’s essential to conduct thorough research and align your choices with your investment objectives

Disclaimer

The content on this platform is for informational and educational purposes only and should not be considered financial, investment, or legal advice. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, reliability, or suitability of the information provided.