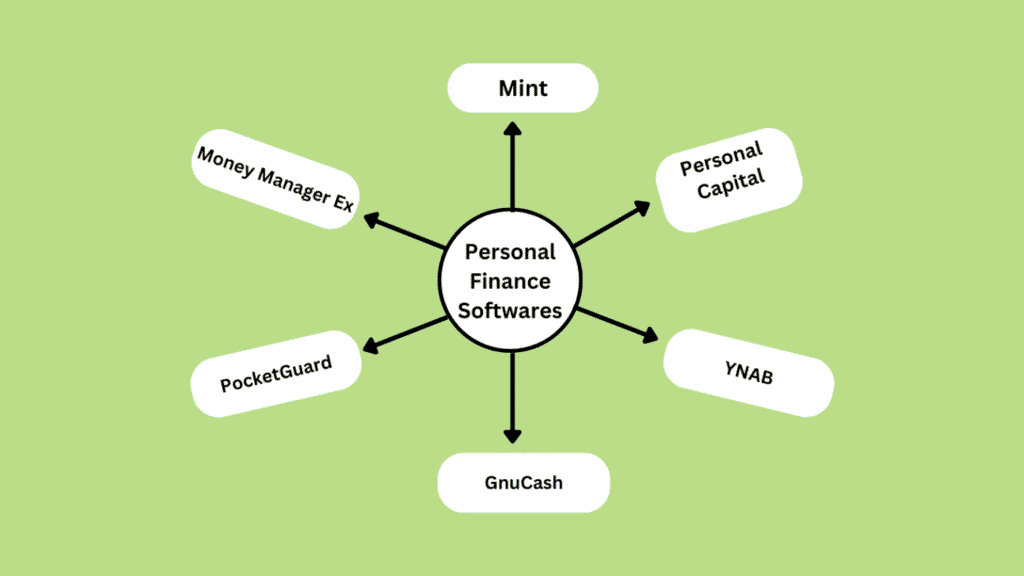

Managing personal finances effectively may crucial for financial stability and growth. Fortunately, there are many free personal finance software options available that help individuals track their income, expenses, savings, and investments without any cost. Whether you want to budget better, eliminate debt, or plan for the future, these tools can simplify your financial management. In this guide, we’ll explore some of the best free personal finance software available today.

Why Use Personal Finance Software?

Personal finance software makes money management easier by providing insights into your spending habits, helping you create budgets, and automating financial tracking. These tools offer several benefits:

- Better budgeting: Track your income and expenses efficiently.

- Debt management: Plan and prioritize debt repayments.

- Investment tracking: Monitor your investments and net worth.

- Goal setting: Save for short-term and long-term financial goals.

Now, let’s dive into the best free personal finance software that you can start using today.

1.Mint

Best for: Budgeting and expense tracking

Mint is one of the most popular free personal finance software, offering a comprehensive way to track income, expenses, and savings. It syncs with your bank accounts, categorizes transactions automatically, and provides insights into spending habits.

Features:

- Automated transaction categorization

- Customizable budgeting tools

- Credit score monitoring

- Bill tracking and alerts

Why Use It? Mint is ideal for individuals who want an all-in-one budgeting solution with automated tracking and insightful reports.

2. Personal Capital

Best for: Investment tracking and net worth analysis

Personal Capital is a powerful tool that focuses on wealth management and investment tracking. It provides a complete financial picture by linking bank accounts, credit cards, loans, and investment portfolios.

Features:

- Net worth tracking

- Retirement planning tools

- Investment performance analysis

- Budgeting capabilities

Why Use It?

If you’re looking for a free tool to monitor your investments and overall financial health, Personal Capital is a great choice.

3. YNAB (You Need a Budget) – Free Trial Version

Best for: Hands-on budgeting

YNAB is known for its proactive approach to budgeting, helping users assign every dollar a job. While the full version requires a subscription, YNAB offers a free trial and educational content to help users build better money habits.

Features:

- Zero-based budgeting system

- Debt payoff tracking

- Financial goal setting

- Syncs with bank accounts

Why Use It?

YNAB is perfect for those who want to take a disciplined approach to budgeting and gain complete control over their finances.

4. GnuCash

Best for: Open-source finance tracking

GnuCash is a free, open-source accounting software that offers detailed financial tracking for individuals and small businesses. It uses a double-entry bookkeeping system for precise accounting.

Features:

- Expense and income tracking

- Bank account reconciliation

- Investment and stock tracking

- Multi-currency support

Why Use It?

If you’re comfortable with accounting principles and want a robust free tool with no ads, GnuCash is a great option.

5. PocketGuard

Best for: Preventing overspending

PocketGuard helps users avoid overspending by analyzing their finances and showing how much money, they can safely spend after covering bills and savings goals.

Features:

- “In My Pocket” feature to track available spending money

- Automatic expense categorization

- Bill tracking and reminders

- Fraud detection alerts

Why Use It?

PocketGuard is excellent for those who need real-time financial insights and spending control.

6. GoodBudget

Best for: Envelope budgeting system

GoodBudget is based on the envelope budgeting method, which divides money into different spending categories to control overspending.

Features:

- Virtual envelope budgeting system

- Syncs across multiple devices

- Debt payoff planning

- Manual expense tracking (no bank syncing)

Why Use It?

GoodBudget is great for individuals and couples who prefer a manual budgeting system with a clear spending structure.

7. Money Manager Ex

Best for: Offline financial tracking

Money Manager Ex is a simple, free finance management software that works offline. It provides budgeting tools, transaction tracking, and financial reports.

Features:

- Simple user interface

- No internet connection required

- Asset tracking and budget reports

- Multiple currency support

Why Use It?

If you prefer a desktop-based, offline finance tool, this personal finance software (Money Manager Ex) is an excellent choice.

Conclusion: Choose the Best Free Finance Software for Your Needs

Using free personal finance software can transform how you manage money, helping you save more, eliminate debt, and invest wisely. The best tool depends on your financial goals:

- For overall budgeting and tracking: Mint or PocketGuard

- For investment tracking: Personal Capital

- For proactive budgeting: YNAB or GoodBudget

- For offline tracking: Money Manager Ex

- For detailed accounting: GnuCash

No matter which personal finance software you choose, taking control of your finances is the first step toward financial freedom. Explore these free options, find the one that fits your needs, and start managing your money more effectively today!

Disclaimer

The content on this platform is for informational and educational purposes only and should not be considered financial, investment, or legal advice. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, reliability, or suitability of the information provided